Helpful Information

You are here: Tuesday, 06 December 2016 23:42

Pre-Approvals Explained

Pre-Approvals Explained Before looking for a house, many home buyers prefer a pre-approval in place first so they can enter into a contract with more confidence knowing how much they can afford and what the loan repayments will be. A pre-approval is actually a full loan application with the Lender…

Wednesday, 03 August 2016 12:32

A Breakdown of Upfront Costs

Recently, there have been a few rumours around Gladstone about needing a 30% deposit to purchase a house. This is not true in the vast majority of cases, so I’ve written this article to show what the actual upfront costs associated with buying your own house in Gladstone are; I’ve…

Wednesday, 27 July 2016 15:06

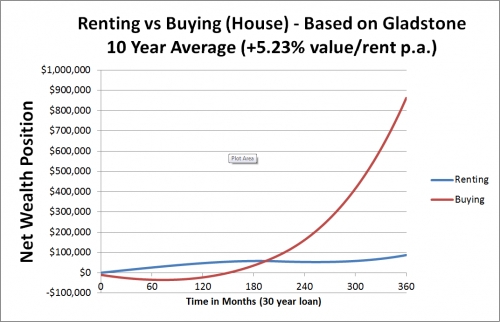

Renting vs Buying

Renting vs Buying – The Math The vast majority of the time, Australians purchase their own house simply because it makes sense for them and their family; but, if you’re anything like me, you may be curious as to the long-term financial effects of renting vs. buying. When I purchased…

Saturday, 16 July 2016 02:05

Stamp Duty Explained

Stamp Duty Explained Stamp duty is a charge which is applied by state governments in Australia on transactions relating to the transfer of land or property. It is paid upfront and needs to be budgeted for in addition to your loan deposit. The amount of stamp duty you are required…

Tuesday, 21 June 2016 13:50

Explainer: how redraw and offset accounts can save you money

Offset accounts and redraw facilities work in similar ways; they both allow you to reduce the balance of your home loan, and therefore the interest charged, by applying extra money to your debt. Redraw facilities allow you to deposit spare income into your home loan account, allowing you to redraw…

Wednesday, 18 May 2016 14:15

The Home Loan Process

The amount of time it takes for you to receive a response to your home loan application can vary. An answer is usually received between two days to two weeks, depending on a range of factors. “For a reasonably straightforward application, it’s 96 hours to a final approval. But, depending…

Wednesday, 18 May 2016 14:12

Explainer: Home Loan Pre-approval

Pre-approval is a lender’s assessment of your likelihood of being approved for an otherwise suitable loan. The appraisal is made on the basis of your ability to service a loan by looking into your living expenses and liabilities, your credit history, your employment circumstances and how often you have moved…

Thursday, 12 May 2016 09:38

What comes first: the property or the loan?

It’s easy to get carried away with the fun part of buying a property – looking at houses – but delaying the less compelling task of arranging finance will weaken your negotiating position on both the property and the loan. Looking for a property to purchase is an exciting time.…

About Us

Whether you are looking to purchase your first home, renovate, refinance or invest, we’re here to negotiate the right finance for you. We’re a one-stop shop with hundreds of loan options available from across Australia’s leading lenders and we’ll work with you to find the right finance solution to meet your needs

Contact Us

Contact Gladstone Home Loans directly on:

Phone: (07) 4978 7422

Mobile: 0428 780 384

Fax: (07) 4978 7433

Email: pmiller@gladstonehomeloans.com.au

Visit our office at:

63 Aramac Drive

Gladstone, QLD 4680